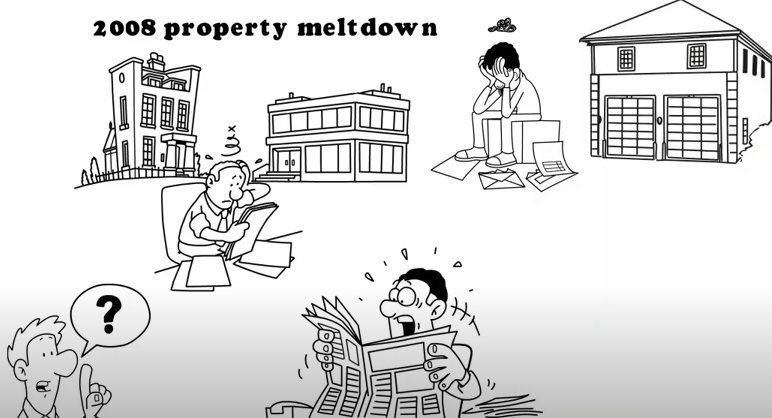

China’s Economic Condition- Housing Crash

It’s no secret that China’s economy is in trouble. One of the most visible signs of this is the country’s housing market, which has been in free fall for the past few years. This has caused a great deal of financial pain for many Chinese families and has put a major drag on the economy as a whole.

Now, it seems that things may be getting even worse. According to a recent report, new home prices in China fell by an average of 9.6% in the first quarter of 2016, compared to the same period last year. This is the biggest quarterly drop on record and it suggests that the housing market is still very much in crisis mode.

What’s causing this latest decline? One factor is that investment decisions are being made more cautiously by both individuals and developers. With the economy weak and uncertainty high, people are simply not willing to take as many risks when it comes to buying or building property.

Another factor is that there is still an oversupply of homes in many parts of China. This was caused by the massive construction boom that took place during the years when the economy was booming. Now that demand has cooled off sharply, there are far more homes than buyers, which is driving prices down further.

It’s hard to say how long China’s housing market will stay in its current slump, but it’s clear that things are not going to get better anytime soon. For now, it looks like anyone is thinking about it.

Bottom Line

As of right now, the question is whether or not the housing market will crash once more. In the opinion of many professionals, a major decline in prices is imminent. The Chinese economy and international markets could be severely impacted if this occurs. It’s unclear how much longer the government will be able to keep things under control after they narrowly avoided a major collapse so far.